Withholding Calculator 2024 For Employers Contribution

Withholding Calculator 2024 For Employers Contribution. Use our fica tax calculator to estimate how much tax you need to pay for social security and medicare tax in line with the federal insurance contributions act. Employers can now calculate payroll for their employees using our free payroll tax calculator, which calculates the net pay after necessary tax withholding.

There is also an option to spread your pay out over 12 months. Use our fica tax calculator to estimate how much tax you need to pay for social security and medicare tax in line with the federal insurance contributions act.

We’ll Even Set You Up For Free

Use our fica tax calculator to estimate how much tax you need to pay for social security and medicare tax in line with the federal insurance contributions act.

Deduction In Respect Of Employer’s Contribution To Nps Is Allowed To The Extent Of 14% Of Salary In Case Of.

Updated on apr 24 2024.

Withholding Calculator 2024 For Employers Contribution Images References :

Source: tracyqcrystal.pages.dev

Source: tracyqcrystal.pages.dev

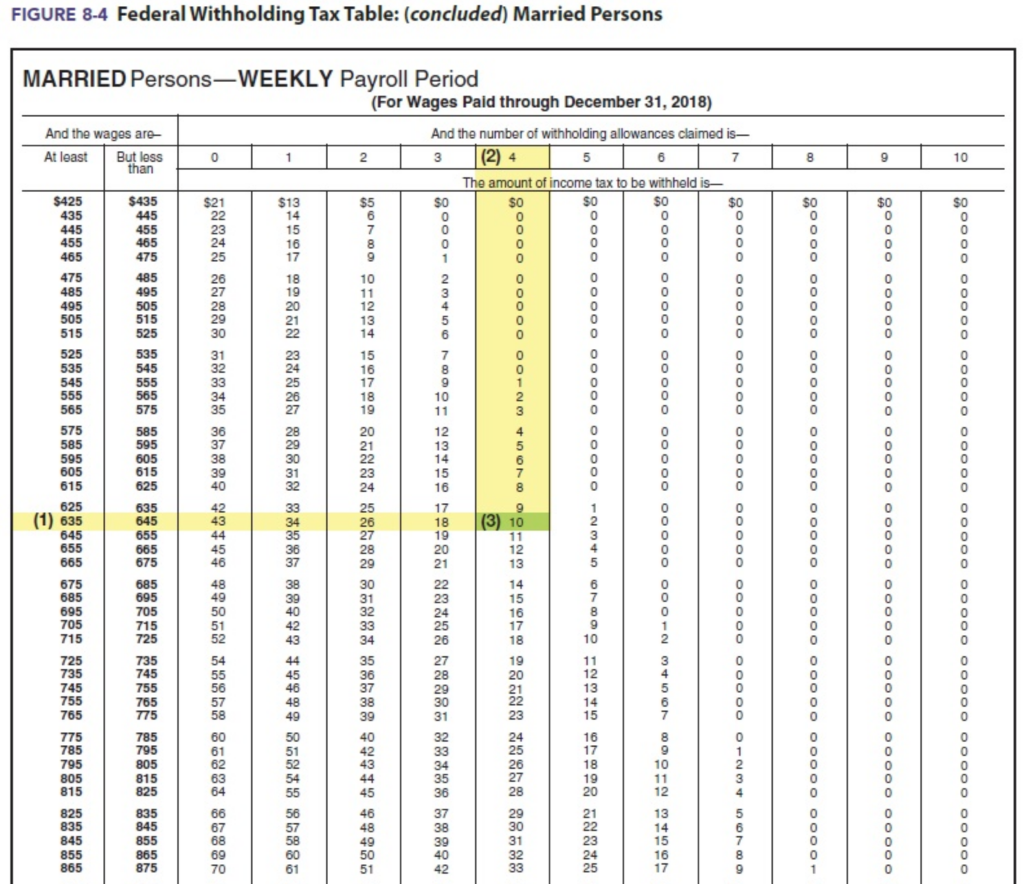

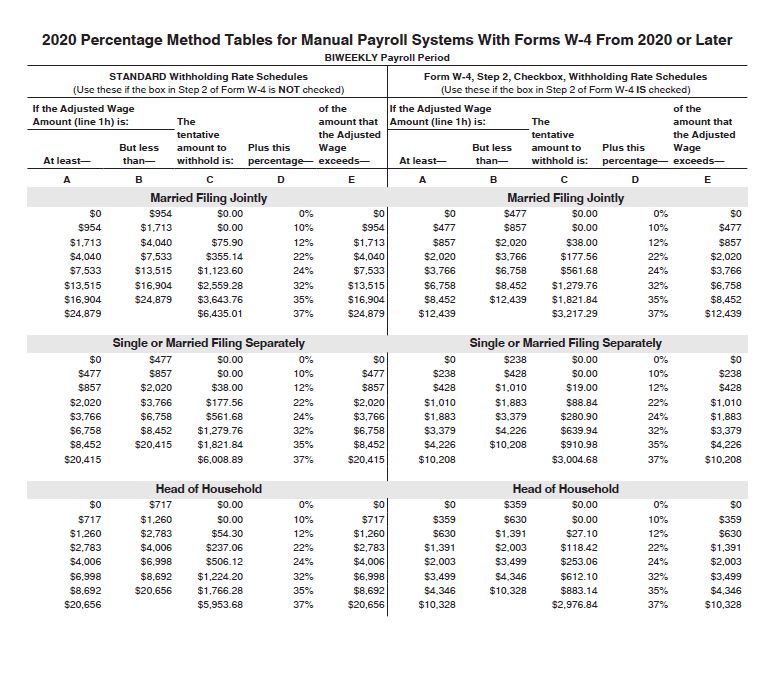

Irs Payroll Withholding Tables 2024 Kipp Simone, Social security tax withholding calculator. If you're an employer or another withholding payer, our tax withheld calculator can help you work out the tax you need to withhold from payments you make to employees and other.

Source: berrieqkarlee.pages.dev

Source: berrieqkarlee.pages.dev

W4 Estimator 2024 Kyle Shandy, Updated on apr 24 2024. Use our easy payroll tax calculator to quickly run payroll in virginia, or look up 2024 state tax rates.

Source: shirleenwzorah.pages.dev

Source: shirleenwzorah.pages.dev

Withholding Tax Table 2024 Semi Monthly Nelia Wrennie, A salary calculator lets you enter your annual income (gross pay) and calculate your net pay (paycheck amount after taxes). Cpp contribution rates, maximums and exemptions.

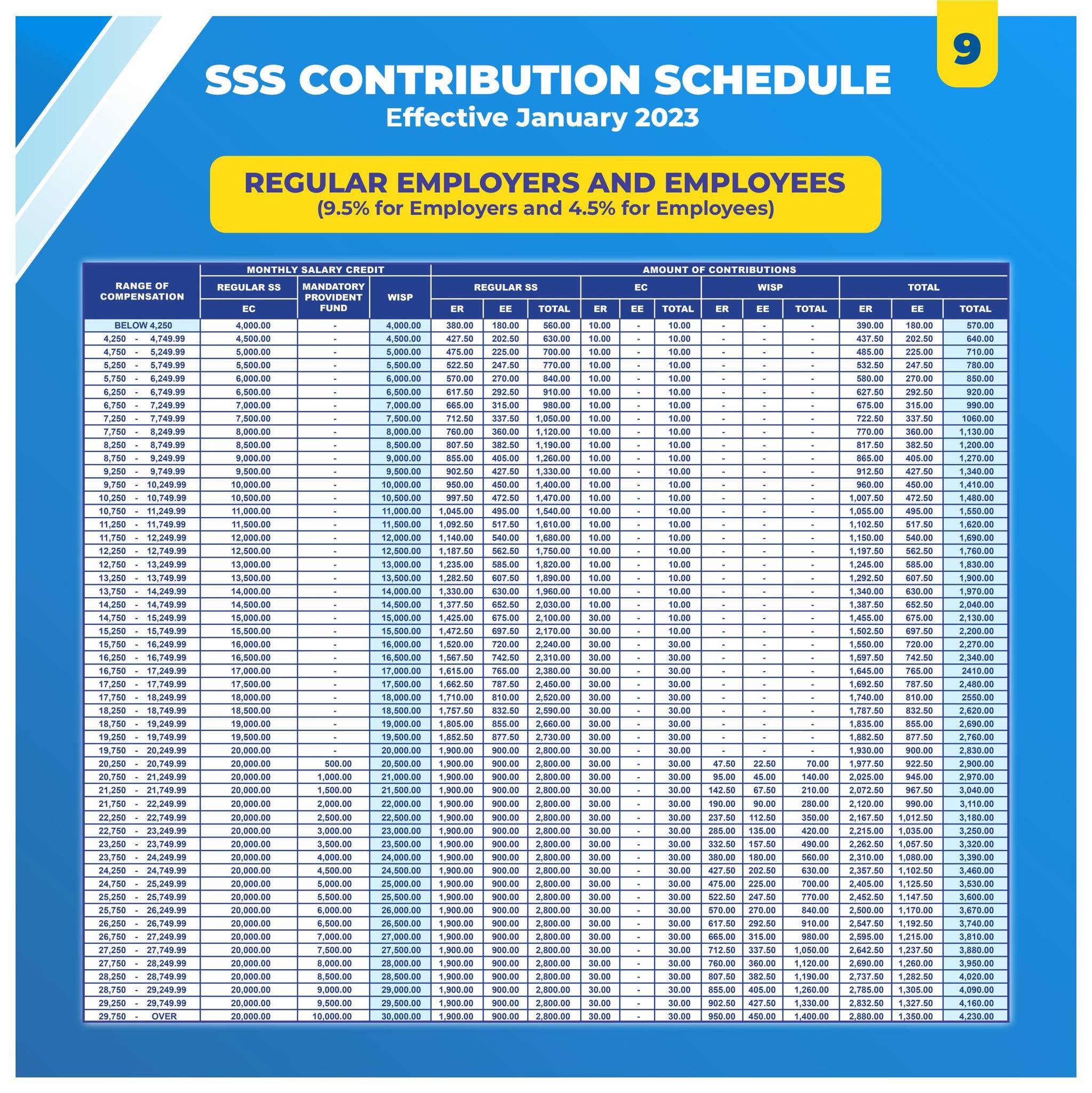

Source: www.howtoquick.net

Source: www.howtoquick.net

New SSS Contribution Table 2024 Schedule Effective January, Updated on apr 24 2024. Cpp contribution rates, maximums and exemptions.

Source: meredithwtonia.pages.dev

Source: meredithwtonia.pages.dev

Tax Calculator 2024 With Dependents Trude Hortense, If you're an employer or another withholding payer, our tax withheld calculator can help you work out the tax you need to withhold from payments you make to employees and other. You need to withhold one half of one percent (0.5%) of each employee’s taxable wages up to the social security contribution base ($168,600 in 2024).

Source: affordablebookkeepingandpayroll.com

Source: affordablebookkeepingandpayroll.com

Tips for Using the NEW Withholding Calculator Affordable Bookkeeping, We’ll even set you up for free You need to withhold one half of one percent (0.5%) of each employee’s taxable wages up to the social security contribution base ($168,600 in 2024).

Source: midgeqviviene.pages.dev

Source: midgeqviviene.pages.dev

Federal Withholding Tables 2024 Allyn Benoite, Employers can use it to calculate. Use our fica tax calculator to estimate how much tax you need to pay for social security and medicare tax in line with the federal insurance contributions act.

Source: florisqwanids.pages.dev

Source: florisqwanids.pages.dev

2024 Federal And State Tax Calculator Corny Madelina, Cpp contribution rates, maximums and exemptions. There is also an option to spread your pay out over 12 months.

Source: jonellwbette.pages.dev

Source: jonellwbette.pages.dev

What Are The Federal Withholding Rates For 2024 Margi Saraann, We’ll even set you up for free Cpp contribution rates, maximums and exemptions.

Source: sayreqamelina.pages.dev

Source: sayreqamelina.pages.dev

How Much Can You Contribute To A Roth Ira 2024 Tybie Scarlet, A salary calculator lets you enter your annual income (gross pay) and calculate your net pay (paycheck amount after taxes). Income tax rates vary by state, like a flat tax of 3.07% in pennsylvania.

How Much Are Your Employees’ Wages After Taxes?

Updated on apr 24 2024.

Employer's Contribution Toward Nps (U/S 80Ccd) I Note:

But every now and then,.

Category: 2024